Student-loan debt is at an all-time high, with both black and white college students borrowing at record levels. But black graduates are much more likely to be saddled with large amounts of debt, according to a new analysis from the Gallup-Purdue Index, which measures the relationship between the college experience and graduates’ lives.

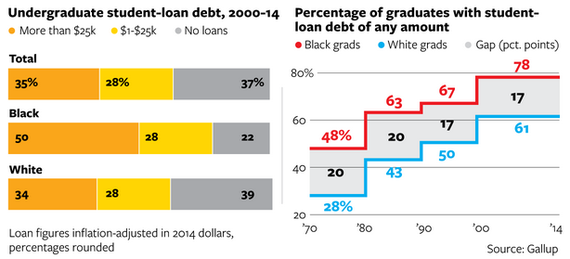

Half of all black graduates reported taking on at least $25,000 or more to complete their undergraduate degrees between 2000 and 2014, compared to 34 percent of white graduates. That borrowing gap is a reflection of other socioeconomic disparities, says Cecilia Rouse, dean of the Woodrow Wilson School at Princeton University and an economics professor specializing in the economics of labor and education.

“It’s about the fact that there is a black-white gap in income and wealth, and that’s what underlies this gap in borrowing as well,” Rouse says.

The average black household in the United States has less than one-tenth the accumulated wealth of the average white household. And rather than shrinking, that gulf is widening. Researchers at Brandeis University estimate that the wealth gap between blacks and whites has almost tripled over the past 25 years. So while the percentage of black and white high school graduates enrolling in college is now almost identical, black college students have far fewer resources to pay for that education.

More than three-quarters of black college graduates say they took out loans between 2000 and 2014, while 60 percent of white college graduates did so. Only one in five black graduates reported no student loans, about half as many as white graduates.

Black College Grads Carry More Debt After Graduation

Given how long it can take to pay off student loans, Gallup researchers call debt levels a “concerning statistic” for the overall well-being of college graduates.

The main concern for Elizabeth Baylor, associate director for postsecondary education at the Center for American Progress, is the impact debt has on delaying economic empowerment. “If the debt burden is too high,” she says, “students from low- and moderate-income families will have trouble making the economic gains that we all know a college degree offers.”

College affordability is especially a concern, Baylor says, given the growing proportion of minority students in college and within the diversifying U.S. population.

“Students of color are increasingly a larger part of our higher education system,” Baylor says, “so as state investment in public colleges has retreated in the past decade, it’s important to make sure that those schools remain affordable to students of color who are a big share of public colleges.”

Rouse points out that student loans do play an important role for students of color, many of whom come from low-income families, in allowing them to pursue higher education and ultimately, social mobility. “Education remains a very solid investment for students in terms of increasing their earning capacity and future labor-market outcomes,” she says. It’s therefore no surprise that so many do borrow, given the disparities that persist in wealth.

What matters more, Rouse adds, is whether students understand and are aware of the repayment options available to them, especially those adjusted for income levels and circumstances.