Progressive economist Jared Bernstein put his finger on the issue, observing that “the systemic racial injustice embedded in the economy” is among the “institutional prejudices” America needs to consider deeply.

I examined this issue after the Ferguson outrage of 2014, noting the persistent economic harassment that afflicted the residents of that city — racial profiling leading to a proliferation of nuisance fines and court fees that would grow exponentially. As a local legal-aid organization documented, clients were “jailed for the inability to pay fines, losing jobs and housing as a result of the incarceration, being refused access to the Courts if they were with their children or other family members.”

But there’s more to it than that. Black unemployment is consistently higher than the white rate, black homeownership rates consistently lower. In virtually every economic metric, black households are mired behind white households. The further behind they fall, the harder it becomes to get a leg on the income ladder and to keep climbing.

As Bernstein and Valerie Wilson of the Economic Policy Institute also observed, black unemployment is more volatile than that of whites — it rises faster in slack times and falls faster as the economy moves toward full employment: “Between 1979 and 2014, the average annual black unemployment rate changed by 1.7 percentage points for every 1-percentage-point change in the national unemployment rate,” Wilson wrote. Real wage growth for black households will also grow faster than in white households, albeit marginally.

One disquieting finding is that black unemployment exceeds white unemployment across all levels of educational achievement. The disparity shrinks as educational attainment rises — it’s largest for those without a high school diploma and smallest for those with college degrees — but it never goes away. The average unemployment rate in 2015 for blacks with a college degree (4.1%), was higher than the rate for whites who had not completed college (4.0%).

Indeed, college graduates are the only black workers with lower unemployment than the national average; whites with no high school diploma are the only whites whose average unemployment rate exceeds the national average. “Persistent disparities in unemployment are constant reminders of how race continues to have an undue influence on life in this country,” Wilson has written.

These are arguments in favor of placing full employment at the forefront of policy goals, Wilson says. That means keeping interest rates low, despite pressure on the Federal Reserve “from monetary hawks to raise short-term interest rates as a guard against price and wage inflation.”

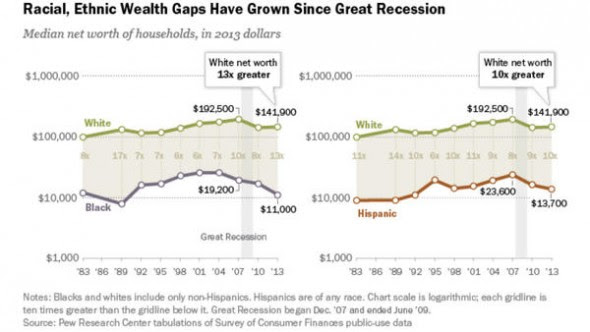

Income disparities are just the tip of the iceberg in racial economic injustice. The racial gap in wealth is even greater.

Blacks and Latinos have fallen further behind white households in net worth since the recession (Pew Research Center)

Blacks and Latinos have fallen further behind white households in net worth since the recession (Pew Research Center)

The Pew Research Center found in 2014 that the wealth of white households had reached 13 times the median wealth of black households, compared with eight times the wealth in 2010. That was the largest gap since 1989, when it was 17-to-1. The gap between white and Latino households was smaller, but still significant. Pew’s study showed that white household net worth had held steady after the recession, while that of black households continued a slide dating back to 2004. Latino family net worth peaked in 2007 and has declined since then.

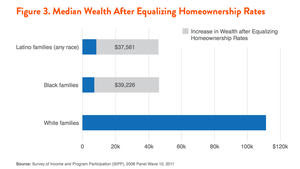

Underlying this gap in wealth is a gap in homeownership, according to Thomas Shapiro and colleagues at Brandeis University’s Institute on Assets and Social Policy. They determined that the racial gap in median net worth tripled from 1984 to 2009, expanding to $236,000 from $85,000. Much of the difference was home equity, which gave home-owning families a leg up in helping relatives with down payments, lowering the cost of borrowing and improving access to credit, Shapiro found. And though some of these advantages were eroded by the housing crash, many long-term homeowners were still able to weather the storm better than renters.

The divergence in home ownership rates was stark, Shapiro’s team foundusing 2011 figures: About 73% of white households owned their homes, compared with only 45% among black households and 47% among Latinos.

If black and Latino homeownership rates matched whites,’ they would experience a huge increase in household net worth. (Thomas Shapiro, Demos)

If black and Latino homeownership rates matched whites,’ they would experience a huge increase in household net worth. (Thomas Shapiro, Demos)

Had homeownership rates merely matched each other, black household net worth would be 450% higher and Latino wealth 350% higher. “If public policy successfully eliminated racial disparities in homeownership rates,” Shapiro and his colleagues observed, “median Black wealth would grow $32,113 and the wealth gap between Black and White households would shrink 31 percent.”

Reducing the homeownership and thereby the wealth gap can be done, but requires aggressive federal policies. Among those spotlighted by Shapiro are strict enforcement of housing anti-discrimination laws; segregation limits the value gains in homes in black neighborhoods, while black and Latino families still face obstacles to moving into predominantly white areas. Fannie Mae and Freddie Mac should be encouraged to reduce principal and make other modifications to homeowners struggling with mortgage burdens in the wake of the housing crash; black and Latino families would be beneficiaries of such policies, which would help them preserve their home equity.

The most important step for Americans in coming to grips with the nation’s racial heritage is recognizing that its social aspects are intertwined with its economics. As long as we fail to recognize the profound obstacles confronting black and Latino Americans in finding jobs and accumulating wealth, the social disparities will never disappear.