A recent Black Wealth Data Center report, using Urban Institute data, explore whether homeownership really is a wealth building tool for Black individuals and families.

A Black Wealth Data Center feature —

Homeownership is critical for building wealth. Yet Black households are significantly less likely to own their home compared with white households. But even when Black households become homeowners, they are more likely to live in structures considered inadequate.

Living in less adequate housing has important implications for the racial wealth gap. The median value of an inadequate property owned by a Black household is lower than both the property of White household living in an inadequate property and a Black household living in an adequate property considered adequate. And compared with these two groups, Black homeowners face higher utility costs relative to the size of their home.

Higher utility costs faced by Black homeowners living in inadequate housing suggests that a home’s property condition may also have impact the wealth of the occupants as well. Black homeowners live under inadequate conditions are more likely to have received a utility shut-off notice. And Black homeowners are also more likely to reduce or forgo basic necessities due to their energy bill or to keep their home at an unhealthy temperature.

Based on the data and the challenges that Black homeowners face, we offer these recommendations for policymakers:

- Support affordable homebuying, refinancing, and renovation spending to close these disparities in property condition and their implications for both wealth building and health risks.

- Facilitate using home equity for homeowners to make improvements.

- Improve renovation assistance to help to close the adequate housing difference between Black and white homeowners.

- Create or expand renovation programs by local governments.

The benefits of homeownership: Black vs. White

Black households are less likely to be homeowners compared with white households.

The Black-white homeownership rate gap has important implications for the broader racial wealth gap. However, emerging research has illustrated that the benefits of homeownership are also lower for Black homeowners (Neal, Choi, and Walsh 2020). For example, data collected by the Black Wealth Data Center suggests that median home values tend to be lower in majority-Black communities compared with majority-white ones.

One key distinction limiting the benefits of homeownership, particularly for Black households, is related to a property’s condition. Lower-income homeowners are more likely to need renovation assistance due to their prevalence of living in inadequate housing (Eisenberg, Wakayama, and Cooney 2021). In addition, recent analysis indicates that Black households are more likely to live in inadequate housing compared with white homeowners. And this disparity partially reflects a history of racial discrimination, potentially including the impact of redlining. Increasingly, researchers are demonstrating the important role played by property condition in the appraisal of a home’s value (Zhu, Neal, and Young 2022).

Highlighting inadequate housing is important because a growing body of research has illustrated the relationship between substandard housing conditions and health risks for Black families (Matthew, Rodriguez, and Reeves 2016). In addition, these families are also more likely to face environmental diseases and injuries (Jacobs 2011). This suggests that poor property conditions not only have implications for the Black-white wealth divide, but also for Black-white health differences, an issue magnified by the COVID pandemic.

Living in inadequate housing corresponds with lower property values

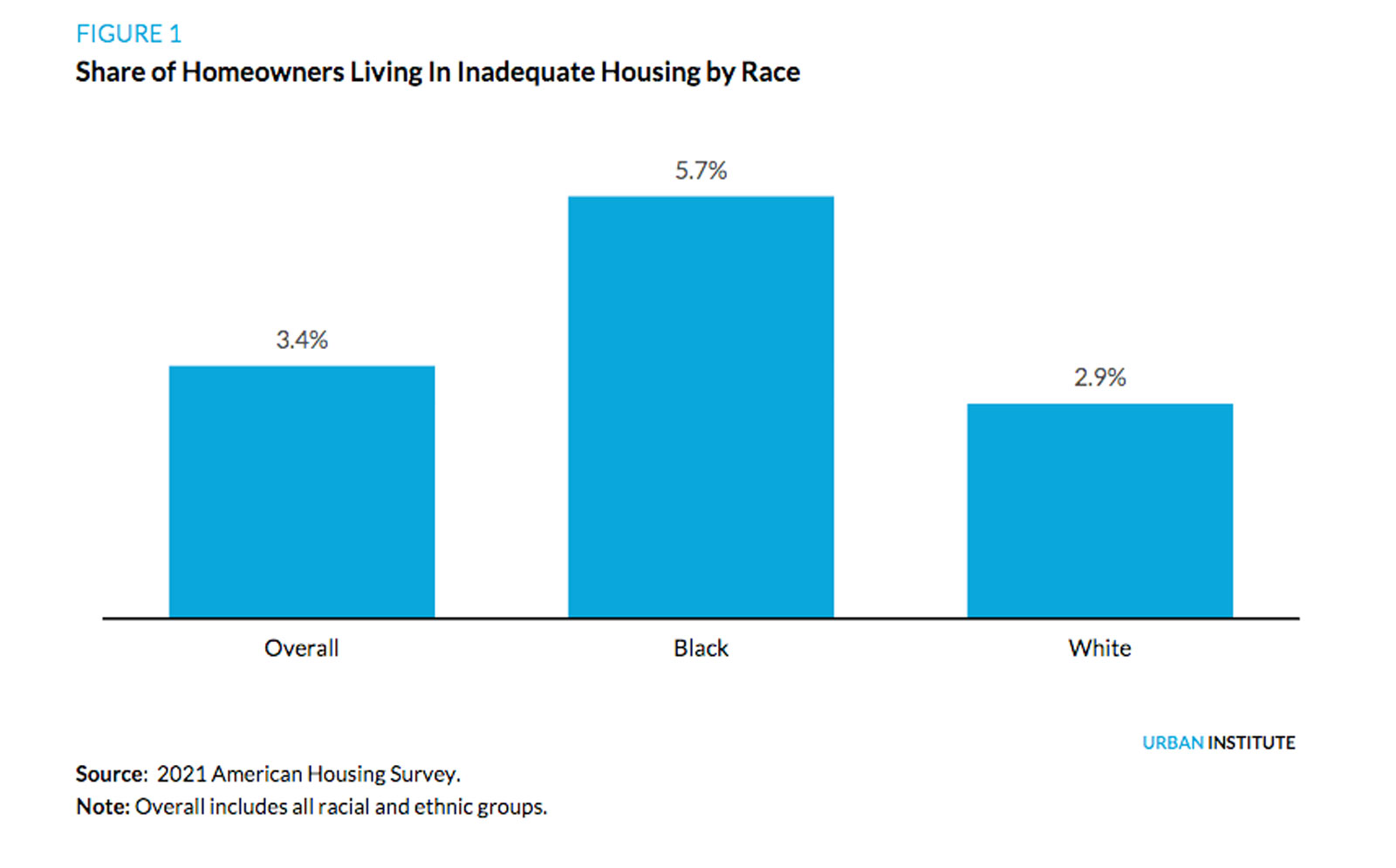

A small percentage of homeowners live in inadequate housing. However, Black homeowners are more likely to live in inadequate housing compared with white homeowners. According to the 2021 American Housing Survey, 3.4 percent of homeowners lived in inadequate housing. Among white homeowners, 2.9 percent lived in inadequate housing. But the share of Black homeowners living in inadequate housing was nearly double the white homeowner average: 5.7 percent

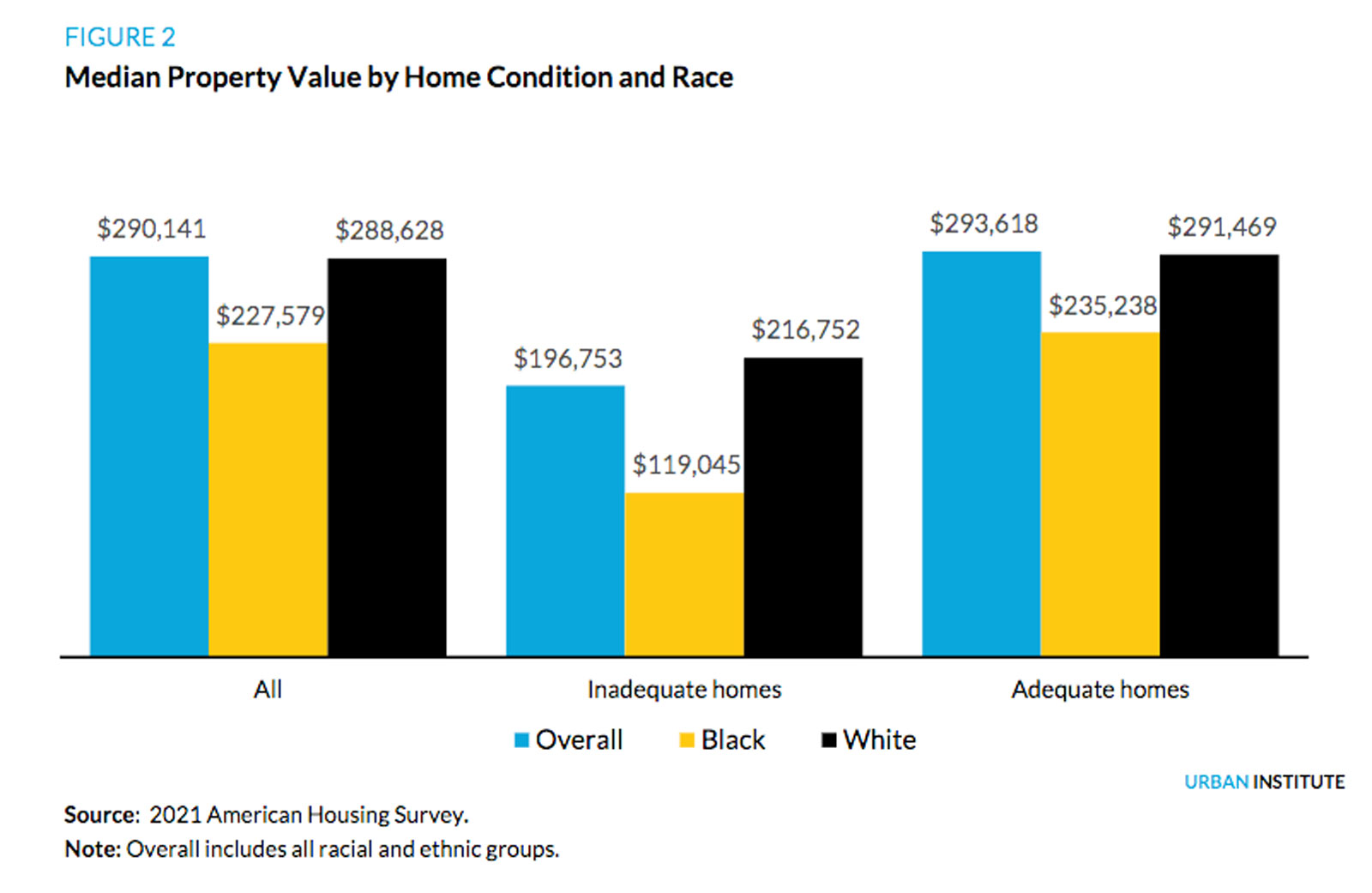

The value of primary residences owned by Black households lags that of white households. In 2021, the median value of a home owned by a Black household was $227,579. This was 21.2 percent less than the median value of a home owned by a white household at $288,628. At the same time, physically inadequate homes may be of lower value than those considered adequate. The median value of a primary residence considered physically inadequate was $196,753 in 2021. This is 33 percent less than the median home considered physically adequate at $293,618.

The value of primary residences owned by Black households lags that of white households. In 2021, the median value of a home owned by a Black household was $227,579. This was 21.2 percent less than the median value of a home owned by a white household at $288,628. At the same time, physically inadequate homes may be of lower value than those considered adequate. The median value of a primary residence considered physically inadequate was $196,753 in 2021. This is 33 percent less than the median home considered physically adequate at $293,618.

Intersecting race and the physical adequacy of the home, the median value of physically inadequate primary residences owned by Black households was the lowest, $119,045, which is 45.1 percent less than the median property value of physically inadequate homes owned by white households, $235,238.

Intersecting race and the physical adequacy of the home, the median value of physically inadequate primary residences owned by Black households was the lowest, $119,045, which is 45.1 percent less than the median property value of physically inadequate homes owned by white households, $235,238.

In addition, it was 49.4 percent less than the median property value of physically adequate homes owned by Black households. And compared with the median property value among white households living in adequate homes, $291,469, the median property values of Black households living in inadequate homes was 59.2 percent less.

Race and the physical adequacy of the home are not the only determinants of a property’s value.

Past research exploring property values found that even with controlling for a broad set of measures focused on household, property, and neighborhood characteristics, race and physical adequacy were still statistically significant determinants of a property’s value (Neal et al. 2021). Intuitively, Black households and physically inadequate homes corresponded with lower property values.

At the same time, instances of racial discrimination may contribute to this gap in property values. Most notably, the underestimation of property values for homes owned by Black households could further widen this racial difference. In addition, incorporating even after adjusting for property condition, appraisal estimates of automated valuation models had greater percentage error in Black communities than white ones (Zhu, Neal, and Young 2022).

Source: B|E strategy – A Black Wealth Data Center feature.