April 8th Edition of Vantage Point Radio Program Focus Report Back from the National Emergency Summit on Gentrification Newark Town Hall Meeting on Gentrification Gentrification: The Negro Removal Program of…

Gentrification is geographically limited in cities, but a new study shows where it has become a crisis, particularly for low-income black households. By Brentin Mock, CityLab — Ron Daniels, president of the Baltimore-based civil-rights network Institute of the Black World 21st Century, assembled a group of some of the foremost African-American social-justice advocates, thinkers, and influencers to Newark this weekend for an emergency summit on gentrification. The emergency is that too many…

APRIL 5, 2019, NEWARK, NJ — Panelists from across the country shared their perspectives on the nature of the crisis and offered ideas for countering the devastating assault on Black communities.

April 1st Vantage Point: Newark Town Hall Meeting on “The Negro Removal Program of the 21st Century”

4/1/19 Vantage Point Radio. Topic: Newark Town Hall Meeting Gentrification, The Negro Removal Program of the 21st Century. Guests Fredrica Bey (New Jersey Coalition for Due Process and WISOMM, Newark, NJ) and Larry Hamm (Chairman People’s Organization for Progress, Newark, NJ).

3/25/19 Vantage Point Radio with Dr. Ron Daniels — Topics Combating Gentrification with Beloved Streets • The Mueller Report. Guests Melvin White (President/CEO, Beloved Streets of America, St. Louis, MO) Mark Thompson (Host of Make It Plain, SIRIUS XM, New York, NY)

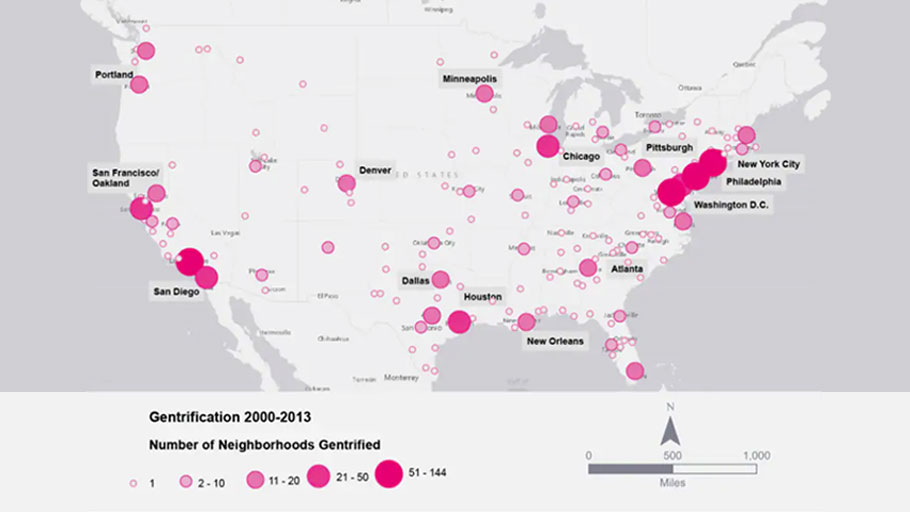

More than 20,000 African American residents were displaced from low-income neighborhoods from 2000 to 2013, researchers say. By Katherine Shaver, Washington Post — About 40 percent of the District’s lower-income neighborhoods experienced gentrification between 2000 and 2013, giving the city the greatest “intensity of gentrification” of any in the country, according to a study released Tuesday by the National Community Reinvestment Coalition. The District also saw the most African American…

The “Negro Removal” Program of the 21st Century National Town Hall Meeting to Assess the Crises of Gentrification in Black America WATCH: The Town Hall Meeting streamed live from the…

National Association of Real Estate Brokers Sign Agreement with Minority-Owned Mortgage Company to Boost Black Home Ownership. MIAMI, Florida – At its recent Mid-Winter Conference in Miami, FL, the National Association of Real Estate Brokers (NAREB) signed a groundbreaking Memorandum of Understanding (MOU) with United Security Financial (USF), a minority-owned mortgage company headquartered in Salt Lake City, Utah to make down payment assistance more broadly available to Black American home…

In Louisville, the group is purchasing vacant homes for low-income families to promote stability in the community and fight gentrification. By Zenobia Jeffries Warfield, YES! Magazine — In May,…

A new study found that people who experience discrimination are almost twice as likely as others to struggle with hunger. By Greg Kaufmann, The Nation — With more than 40 million people in the country struggling with hunger, anti-hunger advocates in the United States have their work cut out for them. In 2017, nearly 12 percent of all US households were food insecure—meaning they didn’t have access to enough food for all household members…

In the US, where homeownership speaks to class, African Americans are being denied mortgages at rates much higher than their white peers By Keeanga-Yamahtta Taylor, The Guardian — As a new year begins and the 2020 presidential election looms closer, our political focus will start to narrow around the issues thought to be most urgent and likely to mobilize voters. One issue surely to be glossed over, if not completely…

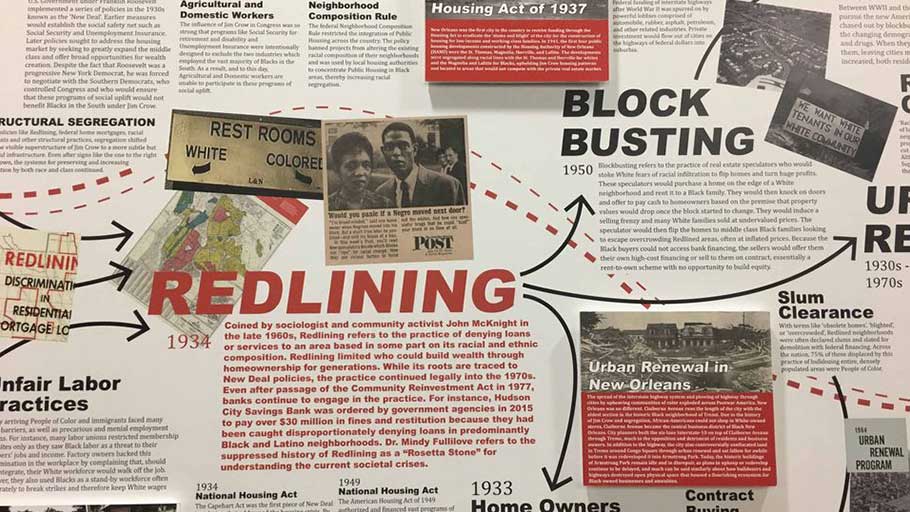

By Jennifer Larino, The Times Picayune — What can we do to break New Orleans and its neighborhoods free from a long history of racist housing policies? That’s the question posed…